wells fargo class action lawsuit payout

Classes in this case are said to include all current and former homeowners that received. In 1987 a FINRA fine of 1 million was paid by the bank for failing to send out the required disclosure documents to customers.

Www Tcpawellsfargo Com Class Action Lawsuits Cash Wells Fargo

According to news reports the class action lawsuit will be filed by plaintiffs with annuity rates exceeding 10 million.

. Under the terms of the settlement agreement Class Members will be automatically entered into the settlement and. April 25 2022 711 PM 2 min read. Under the terms of the Wells Fargo class action lawsuit settlement Class Members can collect two types of cash payments.

The company has agreed to pay 3 billion to resolve the claims. The fines led to a drop in profits by almost 20 billion. Stay informed and share the love.

As a result the bank was ordered to pay out more than 200 million to victims of. Our attorneys serve in a court-appointed leadership position in the Wells Fargo auto insurance class action lawsuit. The class size is limited to a maximum of 200000 homeowners.

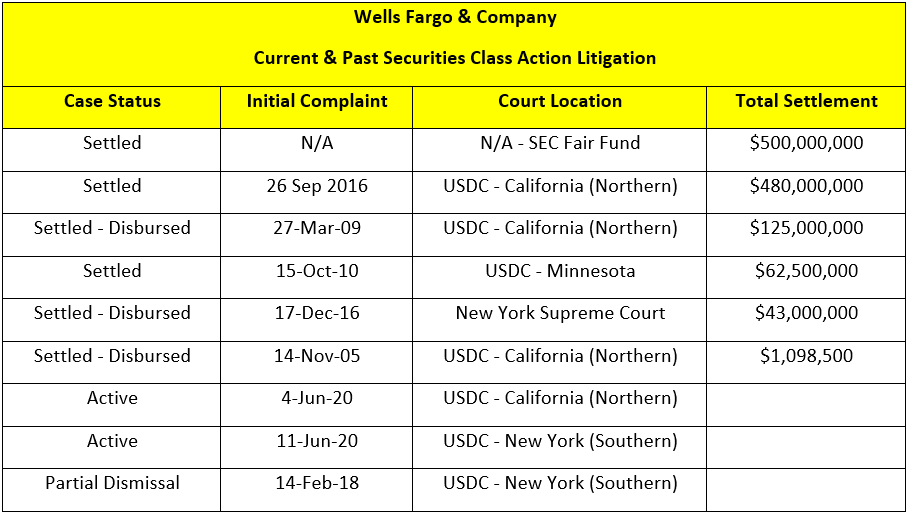

The complaint alleged that Wells Fargo forced unwanted and unnecessary car insurance on its automobile-loan customers without a valid legal basis. Wells Fargo Alter Egos Sold Predatory Home Loans Engineered to Foreclose Claims Borrowers Lawsuit. The settlement includes 500 million in investors money.

Ultimately Wells Fargo denied the class action lawsuits allegations but agreed to pay 185 million to settle the dispute. Nearly 36 million will be paid out to borrower attorney fees and 500000 will cover attorney expenses. A class action lawsuit alleges that banking giant Wells Fargo discriminates against African American borrowers at all stages of the home loan process.

For all businesses that received a phone call from a call center operated by International Payment Services LLC or one of its affiliates between March 7 2011 and May 7 2014 then you are eligible for a potential award from the Wells Fargo Settlement Call Recording Claims Class Action Lawsuit. Wells Fargo the nations fourth-largest bank agreed Friday to pay a 3 billion fine to settle a civil lawsuit and resolve a. Wells Fargo and National General tried getting the lawsuit dismissed but the plaintiffs won.

Wells Fargo Refund of GAP Fees Settlement Claim Form. Fortunately there are a few steps that you can take to increase your chances of receiving a settlement. Lead plaintiff Armando Herrera had alleged Wells Fargo collected the entire amount of the loan including the cost of the GAP insurance coverage.

District Court judge in northern California approved another 142 million class-action settlement in late May for victims of Wells Fargos fake accounts scandal. Henry Umeana is an IT professional with a sterling credit score and he had down payment money ready to purchase a home but he said there was. Read on to learn more about the latest Wells Fargo class action lawsuit updates the potential lawsuit settlement amounts.

Class Representative Proposed Incentive Fee. According to the lawsuit plaintiff alleged International Payment. Consumers who paid off their car loans early and paid what they say were improper GAP insurance fees.

Levin Sedran Berman. Wells Fargo and a group of affiliated mortgage lenders use deceptive tactics to push customers into a complicated risky and expensive loan so they can sell as many loans as possible to third party investors while the. The Settlement resolves a class action lawsuit against Wells Fargo in the United States District Court for the Central District of California Armando Herrera et.

The Wells Fargo Home Loan Class Action Settlement was granted final approval on Oct. While that number is large this doesnt mean that you should give up hope. The investors were misled by the banks cross-sell strategy which involved opening millions.

Ultimately the bank agreed to pay 394 million to address allegations about the unwanted CPIs on car loans. The lawsuit alleges that Wells Fargo failed to provide customers with a partial refund of the fees paid for Guaranteed. The bank estimates up to 35 million accounts were created between.

In the end the company was forced to reimburse overdraft victims 203 million in refunds. By Pete Williams. The parties have reached a 3935 million class action settlement.

Wells Fargo says the error affected 625 homes that were in the foreclosure process between April 13 2010 and October 20 2015. The Wells Fargo lawsuit also covers foreign exchange transactions. The securities filing says that Wells Fargo discovered a calculation error in its automated software for calculating whether a borrower should be offered more favorable loan terms in lieu of foreclosure.

Wells Fargo has not admitted any wrongdoing but agreed to pay 3 million to resolve the claims against it. A settlement deal with the Financial Industry Regulatory Authority has settled class action claims made by Wells Fargo. The banks overdraft policy was found to be unconstitutional under federal law.

Frank Sims Stolper LLP. The Wells Fargo lawsuit is a class action suit over a fraudulent practice by the company. In addition to filing a class-action lawsuit Wells Fargo is obligated to compensate eligible customers.

The Wells Fargo overdraft lawsuit payout 2016 was the result of a long court battle. Azar Associates PC. The Wells Fargo lawsuit filings follow claims of the bank unfairly repossessing property customers receiving mortgage forbearances they didnt ask for customers being wrongfully denied home loan modifications and more.

The company had to pay out 1 billion to other regulators after it was caught. The SEC also filed a similar lawsuit against Wells Fargo in May bringing the largest ever class action lawsuit against a bank. Reimbursement payments are available to Class Members who made.

Wells Fargo Bank NA Case No. In 1992 Wells Fargo settled a class action suit for failing to disclose large currency transactions. Wells Fargo will pay 500 million to end a class action lawsuit refunding US.

Reimbursement payments and distribution payments.

Wells Fargo Agrees To 3 9m Settlement With For Wage Violations

How To Get Your Piece Of The Wells Fargo Banking Scandal Settlement Bankrate Com

Keller Rohrback L L P Wells Fargo Agrees To Pay 110 Million To Resolve Consumers Class Action Lawsuit About Unauthorized Accounts Keller Rohrback

Wells Fargo Mortgage Fee Class Action Settlement Top Class Actions

Wells Fargo Will Pay 190 Million To Settle Customer Fraud Case

Wells Fargo To Pay 3 Billion To Doj Sec To Resolve Criminal Civil Charges Tied To Fake Accounts Scandal Cfcs Association Of Certified Financial Crime Specialists

Wells Fargo Bankruptcy Credit Reporting 3m Class Action Settlement Top Class Actions

Troy Harlow Has Always Made Sure To Pay His Mortgage On Time Wells Fargo Had Other Plans For Him

Investors Closer To 500 Million Payout From Wells Fargo Settlement

Wells Fargo Fake Account Lawsuit Settles For 110 Million Fortune

Wells Fargo To Pay 500m To Settle Gap Insurance Fees Class Action Top Class Actions

Wells Fargo Under The Spotlight Again This Time For Monthly Service Fees Top Class Actions

Wells Fargo Finds Another 1 4m Fake Accounts Will Refund Another 2 8m Wells Fargo Account Wells Fargo Fargo

Wells Fargo Account Fraud Scandal Wikiwand

Wells Fargo Fcra Class Action Settlement Top Class Actions

Wells Fargo Reaches 3 Billion Settlement Over Fake Accounts Scandal The Washington Post

A Black Homeowner Is Suing Wells Fargo Claiming Discrimination The New York Times

How To Get Your Piece Of The Wells Fargo Banking Scandal Settlement

Wells Fargo Customers Won T Be Able To Sue The Bank Over Fake Accounts The Denver Post